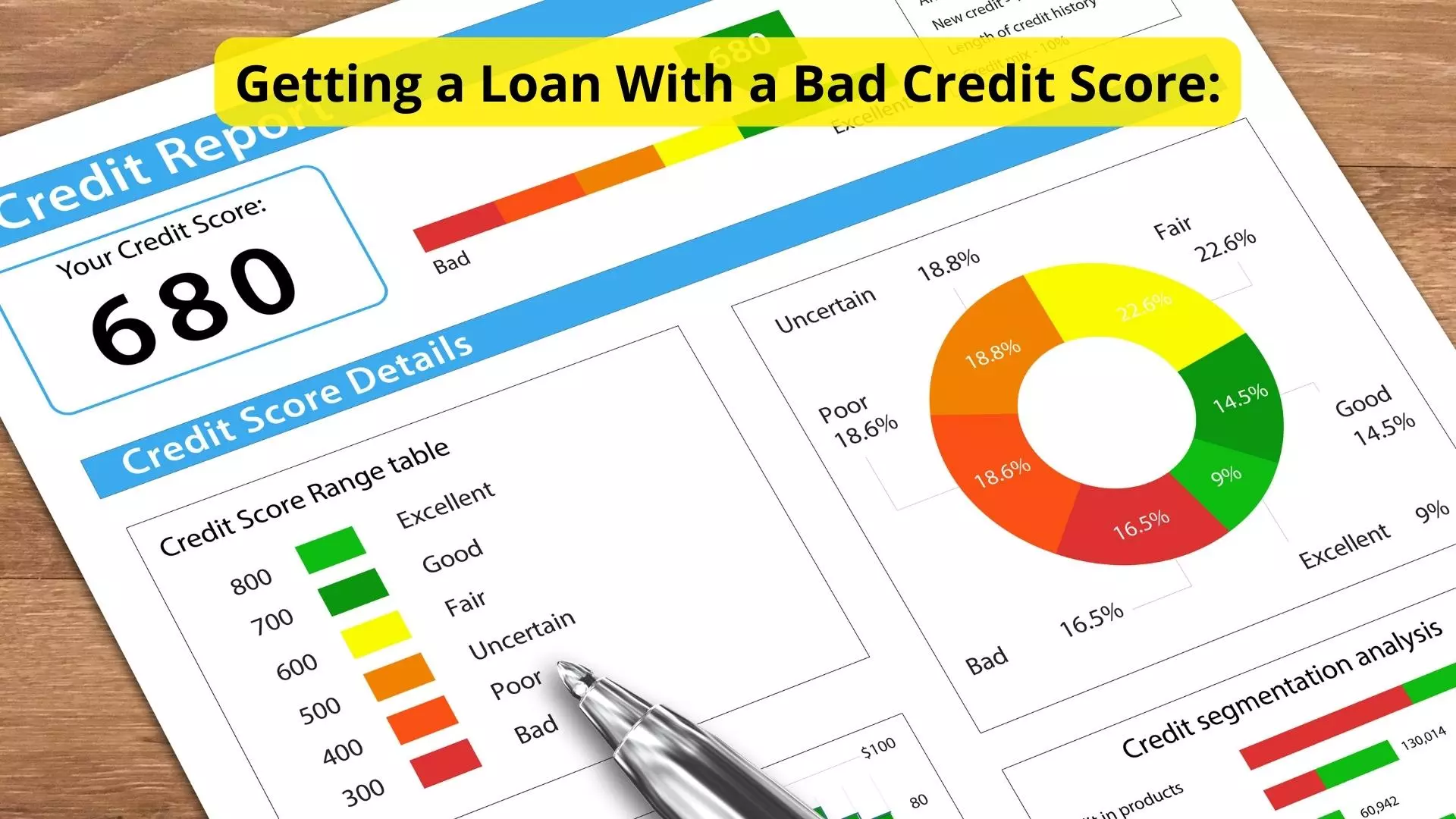

If you have a bad credit score, you may feel like getting a loan is impossible. But the truth is, there are still options available to you. So, here are some strategies for getting a loan with a bad credit score.

Understand What You’re Up Against

You can get small loans for bad credit, but the first step is to understand what you’re up against. Lenders use your credit score to determine your creditworthiness or how likely you are to pay back a loan. If you have a bad credit score, lenders may see you as a high-risk borrower and be hesitant to lend you money.

However, not all lenders are the same. Some lenders specialise in working with people who have bad credit scores. These lenders may offer loans with higher interest rates or require collateral, but they can still provide you with the funds you need.

Consider a Secured Loan

One option for getting a loan with a bad credit score is to apply for a secured loan. When it comes to getting a secured loan, provide collateral to secure the loan. This collateral could be your home, car, or another asset.

By putting up collateral, you’re showing the lender that you’re serious about paying back the loan. If you default on the loan, the lender can seize the collateral to recoup their losses. This reduces the lender’s risk and makes it more likely that they will approve your loan application.

Also Read: Things to Look for in Your Credit Report

Look for a Co-Signer

Another strategy for getting a loan with a bad credit score is to find a co-signer. A co-signer takes on responsibility for the loan if you can’t make the payments. This could be a family member or friend with good credit.

When you get yourself a co-signer, your lender will take both of your credit scores into account when deciding whether to approve the loan. If your co-signer has good credit, it can offset your bad credit score and increase your chances of approval.

Improve Your Credit Score

While it may not be a quick fix, improving your credit score is one of the most effective strategies for getting a loan with a bad credit score. Start by reviewing your credit report for errors and disputing any inaccuracies. Then, focus on paying off any outstanding debts and making all of your payments on time.

You can also consider using a credit repair service to help improve your creditworthiness. These services can help you dispute inaccurate information on your credit report, advocate with credit report agencies to remove negative information and develop a plan to improve your credit score.

Shop Around for Lenders

Not all lenders are created equal; some may be more willing to work with you than others. Feel free to shop around for lenders and compare rates and terms. Look for lenders specializing in working with people with bad credit scores, as they may be more likely to approve your loan application.

When comparing lenders, pay attention to the interest rate, fees, and repayment terms. Make sure you understand all of the terms before signing the loan agreement.

Also Read: How to Start a Business Without Money

Consider Alternative Lenders

Finally, consider alternative lenders when looking for a loan with a bad credit score. Alternative lenders include online lenders, peer-to-peer lending platforms, and credit unions. These lenders may have more lenient credit requirements and be more willing to work with borrowers who have bad credit scores.

However, be aware that alternative lenders may charge higher interest rates and fees than traditional lenders. Ensure you understand the terms and fees before agreeing to a loan.

Getting small loans for bad credit may be challenging, but it’s possible. By understanding your options, improving your credit score, shopping around for lenders, and considering alternative lenders, you can increase your chances of getting approved for a loan. Remember to read all of the terms and fees carefully before agreeing to a loan, and always make sure that you can afford the payments before taking on any debt. With some patience, diligence, and the right strategy, you can get the loan you need, even with a bad credit score.